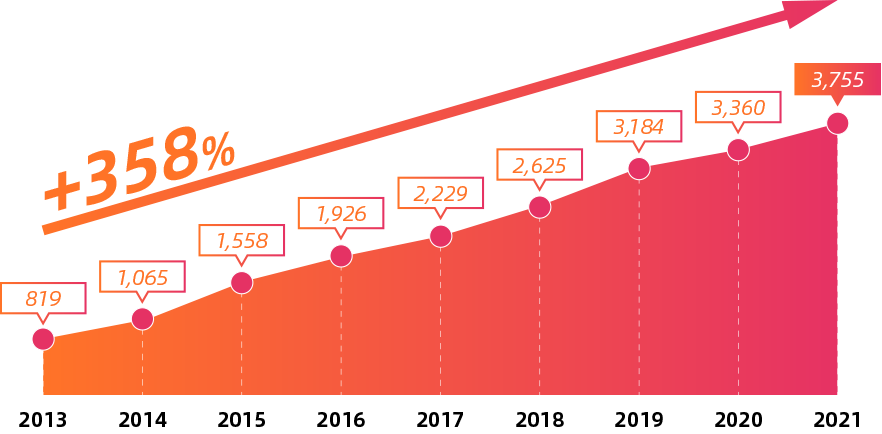

There have been encouraging efforts by multiple stakeholders to foster a thriving I&T ecosystem in Hong Kong. The integration of Hong Kong's I&T sector within the Greater Bay Area will be a key catalyst for growth.

-

Employ a comprehensive strategy to bolster integration with the Mainland GBA cities, with a focus on harmonising different institutional systems: The GBA is crucial to scaling up Hong Kong's I&T development, but institutional differences remain a challenge. The Government should harmonise regulations and strengthen cross-border connectivity and support in order to better integrate Hong Kong startups within the GBA network. Additional marketing should be done to increase visibility and promote cross-border business support that is available to Hong Kong startups who wish to expand into GBA.

-

Accelerate I&T adoption through 360-degree public procurement: To build public confidence in startups' digital solutions, the Government could enhance public procurement, for example through dynamic contracts or spiral contracting. It should increase the visibility of measures to increase startups' participation in public.

-

Establish an independent research-industry consortium to forge long-term collaboration between academia, R&D centres and industry: This body would bring together researchers and industry players in Hong Kong, GBA Mainland cities and globally to cultivate a multi-disciplinary research environment and promote technology transfer. Clear governance and guidelines on joint research, commercialisation and intellectual property (IP) should be defined at the start.

-

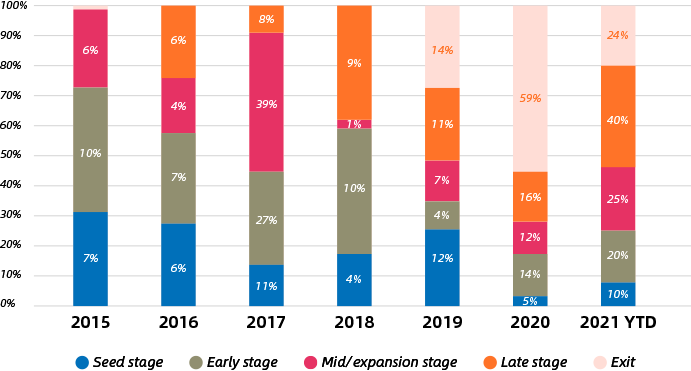

Enhance co-investment schemes by increasing risk appetite and introducing alternative models: The Government should enhance its co-investment programmes to more aggressively inject funding into high-risk, high-impact and scalable startups. One consideration is to update ITVF's co-investment ratio, which would also encourage more private investors to invest in local ventures.

-

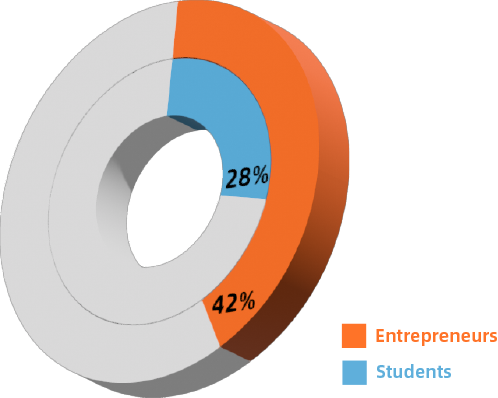

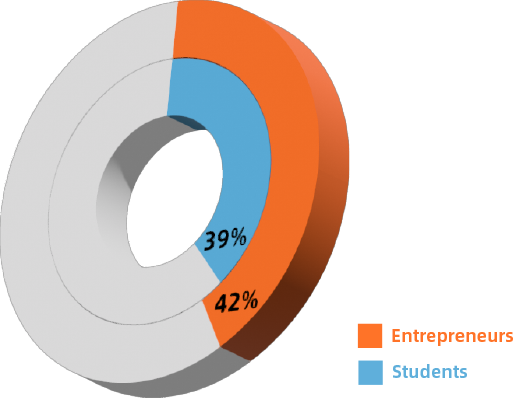

Strengthen policies to attract global talent and build a sustainable pipeline of local talent:

The Government could i) expedite the hiring of foreign I&T talent via dedicated visa channels, ii) provide a fast-track to permanent residency for top I&T talent, iii) reduce innovation costs through affordable office spaces or tax incentives, and iv) entice talent to work in Hong Kong after the outbound employee programmes end.

To nurture local I&T talent, the Government could establish a body to facilitate the implementation of STEM education and introduce state-of-the-art technologies in schools. This would give students the experience of interacting and experimenting in the metaverse.

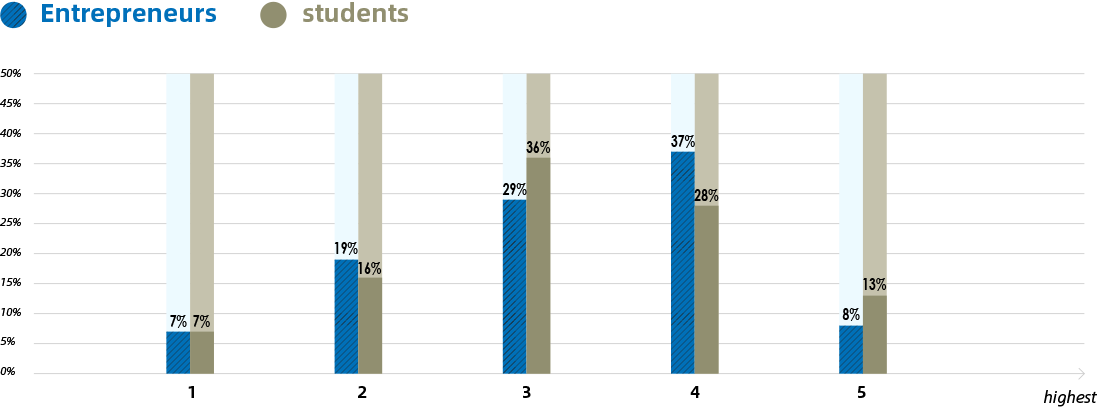

Entrepreneurship must be seen as a desirable, viable career. More can be done here, including by including entrepreneurship in career education, and matching students with mentors, or providing internship opportunities, at startups.