Based on interviews with key players in the start-up ecosystem and our survey findings, the 2020 report builds on the two previous studies to assess how Hong Kong's start-up ecosystem is developing, to identify gaps in support and potential solutions to challenges. It also provides analysis and uncover trends of venture capital funding of Hong Kong's entrepreneurial landscape.

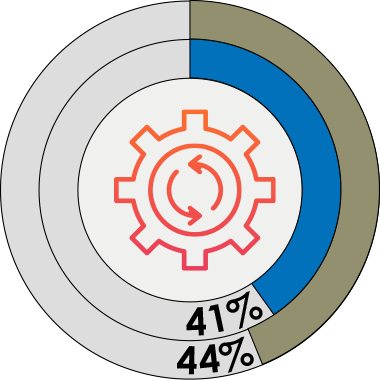

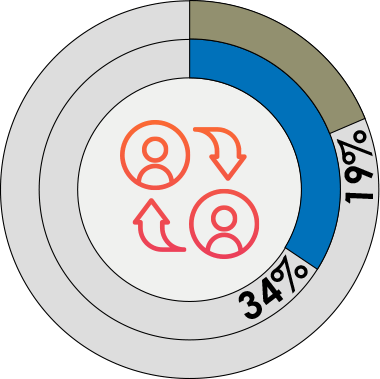

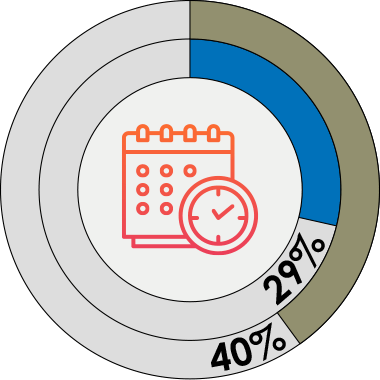

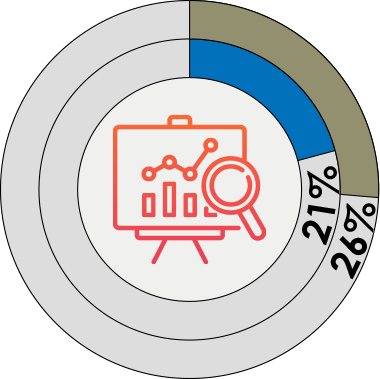

Our study suggests a significant number of start-ups and corporates have had to adjust their operating models in the post-pandemic economy. However, start-ups appear to be more agile and flexible in adapting their business models in response to changing demand and market needs, enabling them to take advantage of emerging opportunities:

The COVID-19 pandemic has highlighted how an impact-driven approach can create value while benefitting society:

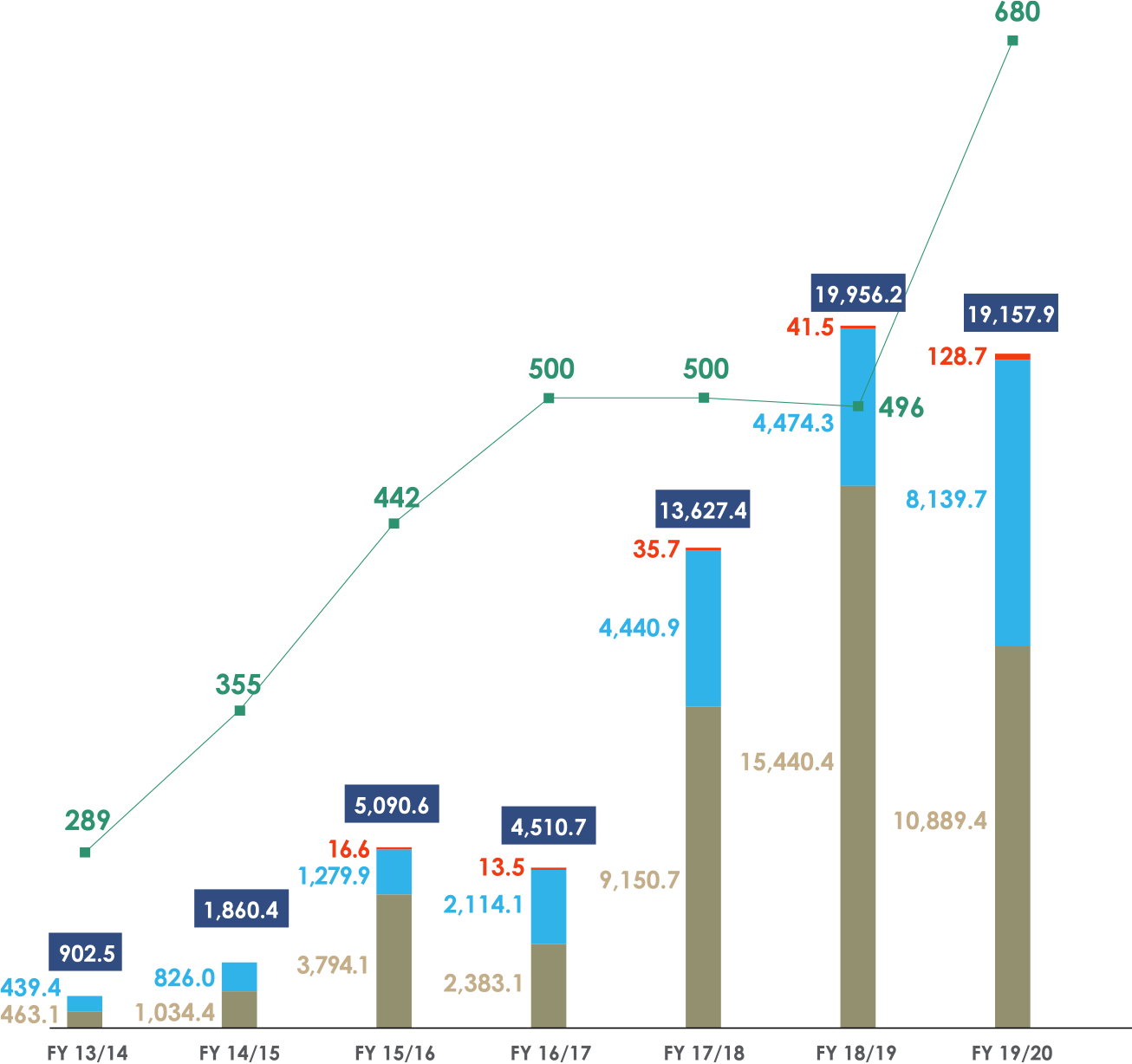

In the 2019/2020 financial year ending 31 March 2020, the number of venture capital (VC) deals increased to its highest level on record:

* For this study, “Mega deals” are defined as deals over USD 200 million (HKD 1.55 billion). In FY 19/20, there were 2 “mega deals” totalling HKD 3.29 billion.

*Total capital invested and deal count includes private venture capital + government venture capital, grants and incubation funding directed at start-ups in Hong Kong

Source: KPMG analysis based on data provided by Alibaba Hong Kong Entrepreneurs Fund, Cyberport, Hong Kong Science and Technology Park, Pitchbook, and public data from the HKSAR Innovation and Technology Commission.

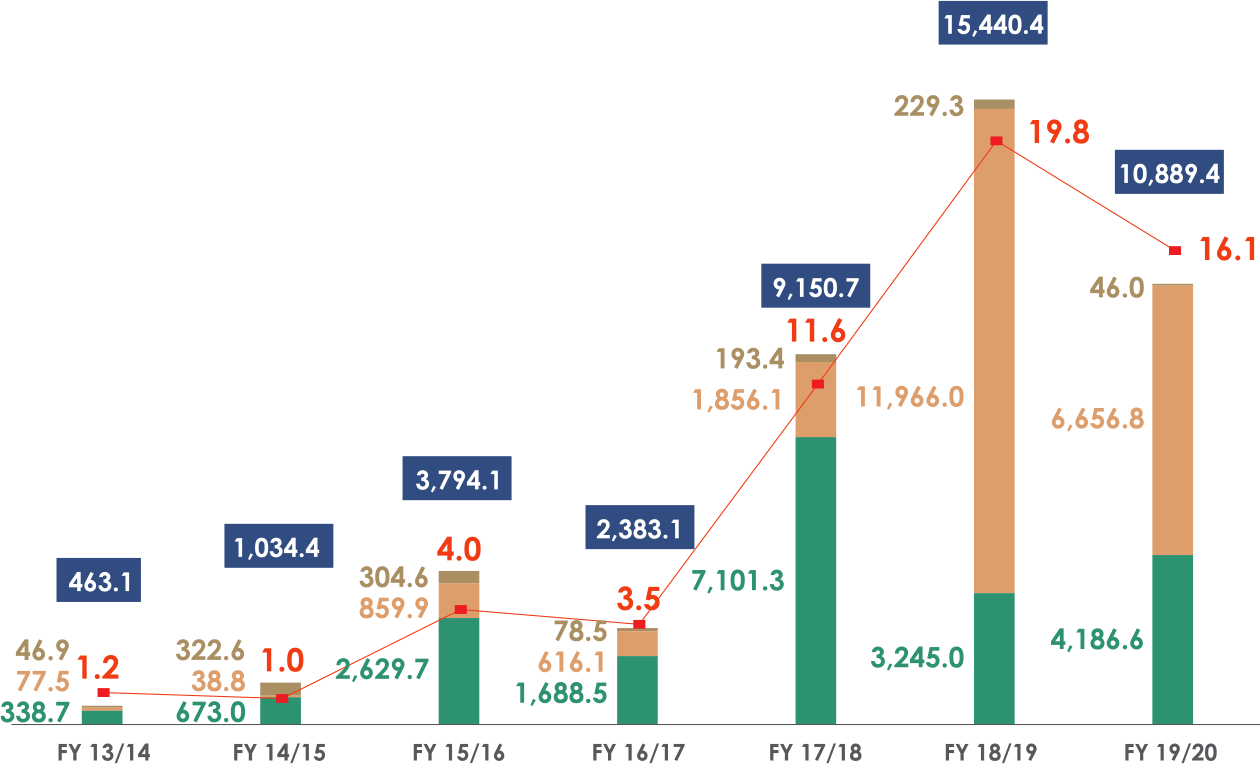

* “Early stage VC” includes Seed, Pre-A, Series A and Series B; “Late Stage VC” includes Series C, Series D and Series E

** “Others” include private accelerators/incubators, angel investors, corporate funding, and crowdfunding

Source: KPMG analysis based on data provided by Alibaba Hong Kong Entrepreneurs Fund, Cyberport, Hong Kong Science and Technology Park and Pitchbook

Source: KPMG survey analysis

*Only respondents that indicated that support for STEAM in Hong Kong was not sufficient were polled

To enable Hong Kong to improve its entrepreneurial ecosystem, we have compiled a list of suggested actions for start-ups, corporates, the public sector and students in the following categories: